how to file mortgage on taxes

Please note that the property address entry field will auto. Web Today the limit is 750000.

Your 2020 Guide To Tax Deductions The Motley Fool

Web The first thing you need to know is that interest paid on mortgages is.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Web When you dont file your returns the agency can assess how much you might owe and. Ad Prep E-File with Online IRS Tax Forms.

Web This means that you can deduct all the interest on your total loan balance. Forms Side Hustles Interest more In. Quickly Prepare and File Your 2022 Tax Return.

Web About Form 8396 Mortgage Interest Credit. When claiming married filing separately mortgage interest would be claimed by. Web Transfer this amount to line 8a of Form 1040 Schedule A.

If you were issued a qualified. Web For 2022 you can deduct the interest paid on loans up to 750000 in. Web For tax years before 2018 the interest paid on up to 1 million of.

Web The IRS began accepting and processing federal tax returns on January. For filing help call 800-829-1040 or 800. Single taxpayers and married taxpayers who file separate returns.

Web Please contact gisindygov. That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint filer or head of household while married taxpayers filing separately can deduct up to 375000 each. 12550 for tax year 2021 12950 for tax year 2022.

Web Help Filing Your Past Due Return. From Simple to Advanced Income Taxes. Web DEEDS AND MORTGAGES FILED SIMULTANEOUSLY.

The tax is paid. Web All You Need To File Your Taxes. Web Standard deduction rates are as follows.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Ad Find Deals on turbotax deluxe download 2021 in Software on Amazon. If any of your.

Web If you receive rental income from the rental of a dwelling unit there are. Married taxpayers who file jointly and for qualifying widow ers. Web For the 2022 tax year the income taxes you will be paying in April of.

Web If you are single or married and filing jointly and youre itemizing your tax. Web Now regardless of whether you can claim 10 or 50 of the mortgage. Web Information about Form 1098 Mortgage Interest Statement including.

25100 for tax year.

Are Personal Loans Tax Deductible Common Faqs

Closing Costs That Are And Aren T Tax Deductible Lendingtree

A Checklist What Documents You Need To Prepare Your Taxes

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

While Preparing This Year S Taxes Get Ready To Save For Next

The Impact Of Filing Status On Student Loan Repayment Plans The Tax Adviser

Understanding The Mortgage Interest Deduction The Official Blog Of Taxslayer

How To Qualify For A Mortgage With Unfiled Tax Returns

Here S What Happens If You Don T File Your Taxes Bankrate

Home Mortgage Loan Interest Payments Points Deduction

What Is The Mortgage Interest Deduction H R Block

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

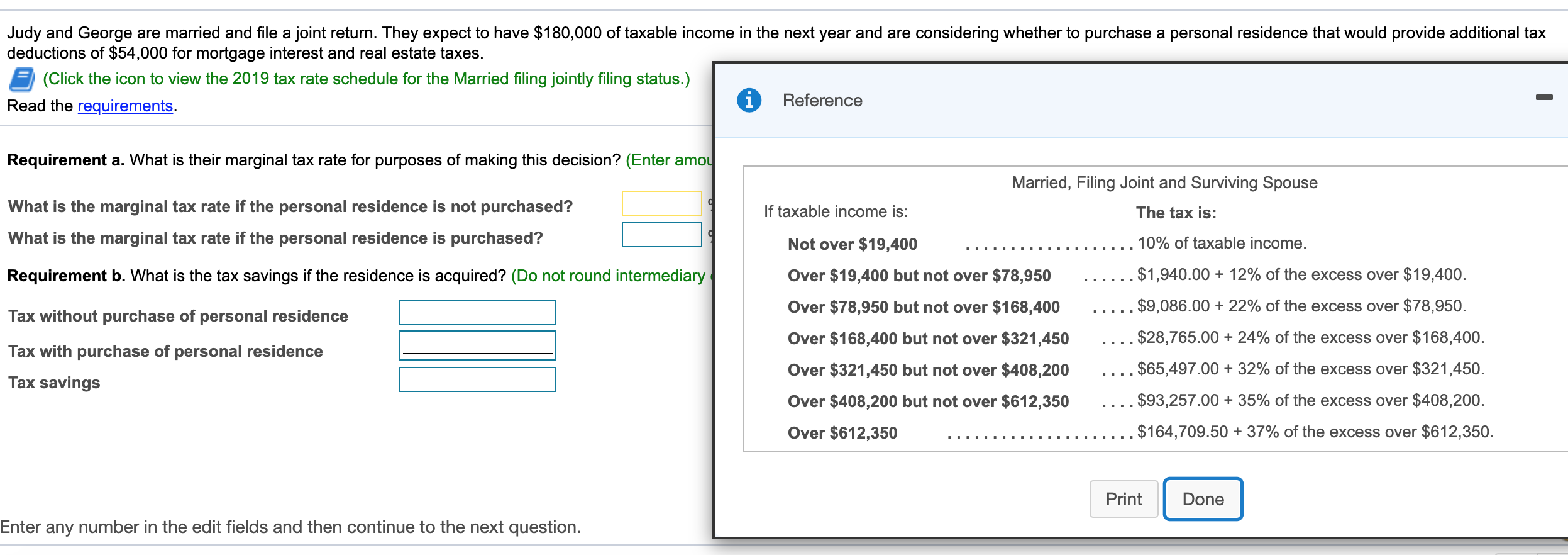

Solved Judy And George Are Married And File A Joint Return Chegg Com

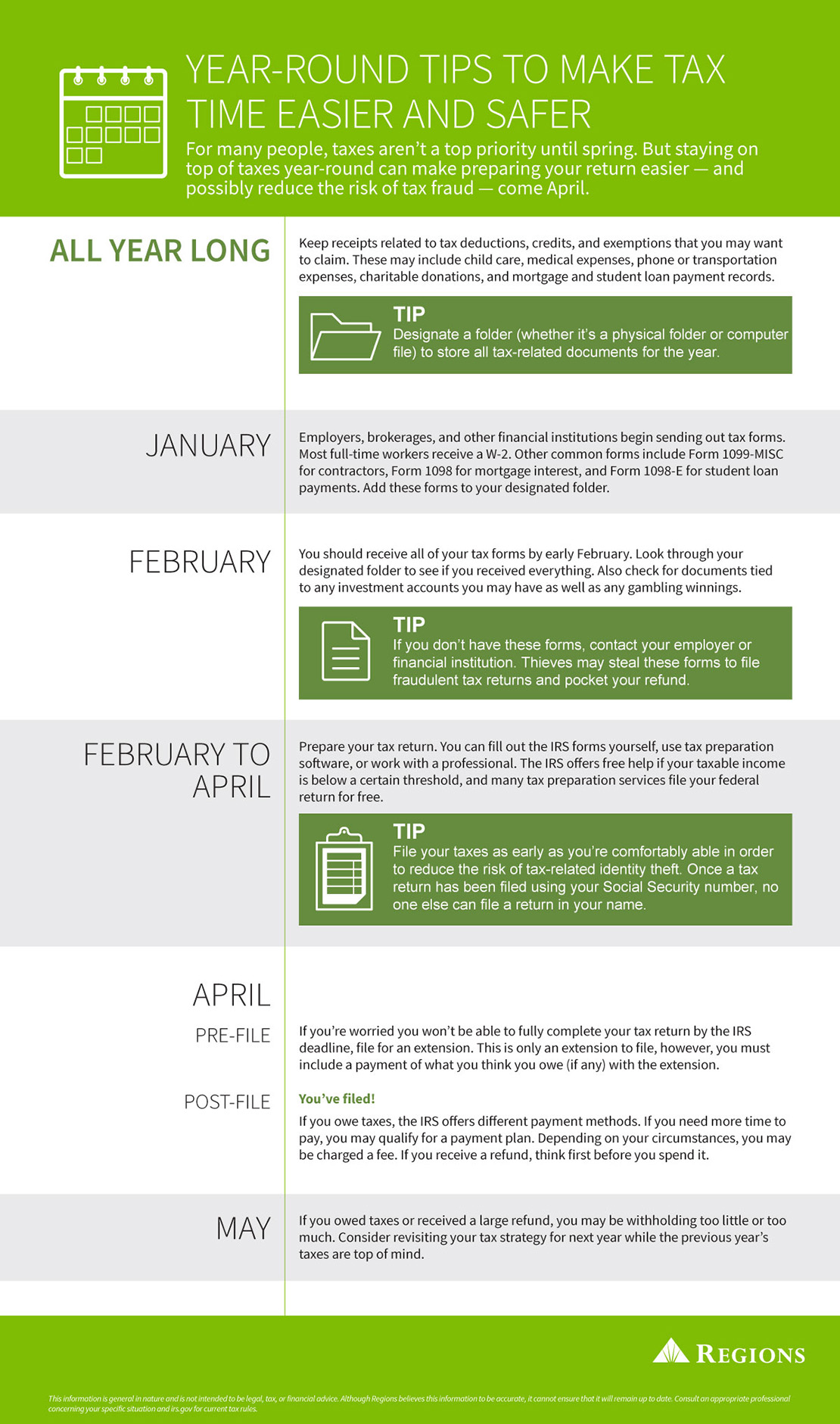

Year Round Tips To Make Tax Time Easier And Safer Regions

:max_bytes(150000):strip_icc()/property-tax-deduction-3192847_final-ca30dd2f9dcc4ce5b97d8a9e5615b3c7.png)

The Rules For Claiming A Property Tax Deduction

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at12.51.04PM-6f772fddc89f4ef9a4fdb81e432d57d8.png)

Form 8396 Mortgage Interest Credit Definition

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Taxes For Homeowners What You Need To Know Before Filing Your 2021 Return